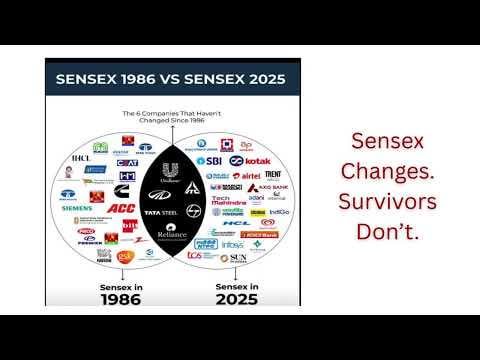

The 27 January 2025 macro wrap connects balance sheets, behaviour, and long-term bets across regions: Europe is quietly shortening debt maturities as yield curves steepen, trading lower interest costs today for higher refinancing risk tomorrow, while India’s growth story hinges less on new reform slogans and more on execution speed at the state and institutional level.Global capital flows reveal selective confidence, with Europe heavily exposed to US equities rather than Treasuries, and wealth concentration accelerating as winner-takes-most markets dominate. In India, mutual funds highlight a long financialisation runway, startups show scale without enough depth, and exports finally tilt toward electronics over crude—signalling a structural upgrade. The Sensex comparison across decades ties it together: indices change, sectors rotate, and only adaptive firms survive, reminding investors that compounding rewards evolution, not nostalgia.

#MacroeconomicAnalysis #IndiaEconomy #GlobalDebt #BondYields #ReformsAndGrowth #IndiaExports #SensexHistory #EquityMarkets #GlobalCapitalFlows #Financialisation #StartupIndia #EconomicOutlook2025 #GlobalMacro #RajeshKaz #Kazedge

Source: ykar648

1 Comment

Soo are mutual funds still worth it ?, and sips.