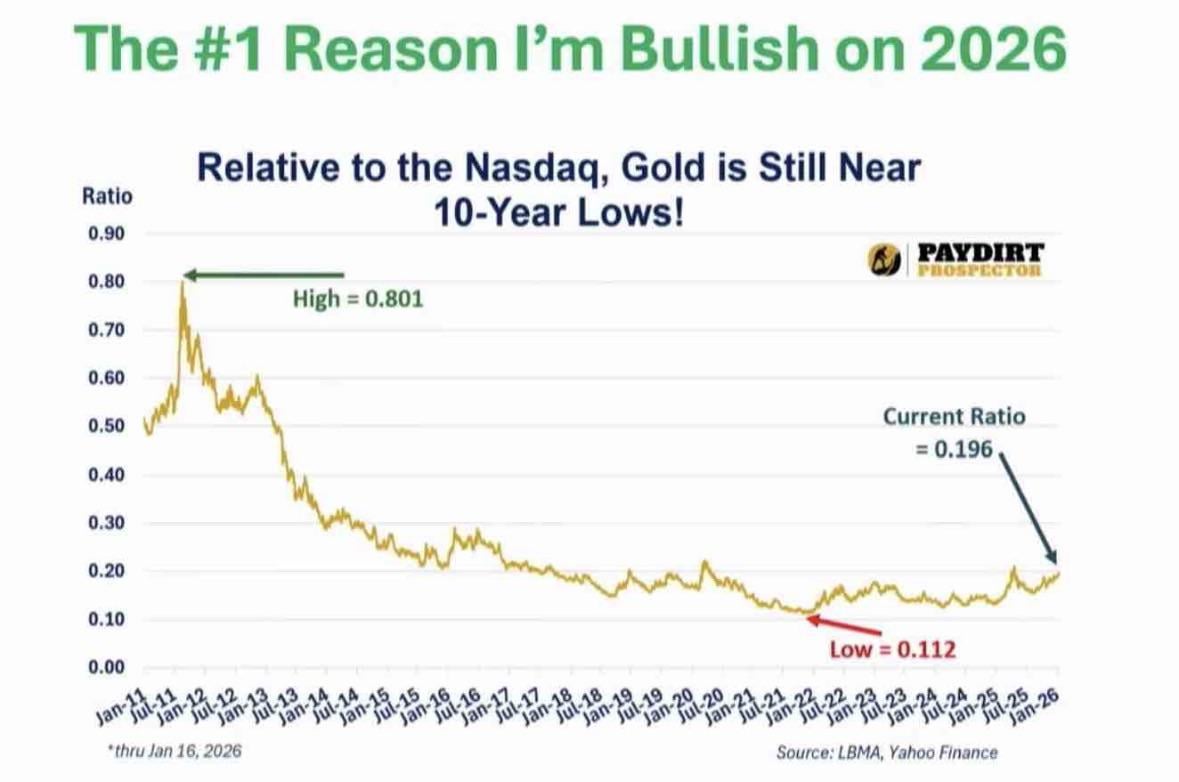

This might not mean much on its own, but the gold-to-Nasdaq ratio is interesting.

At its peak around 2011, gold was worth ~80% of the Nasdaq index level. By 2022-2023, that fell to ~11%. As of mid-January 2026, it’s around ~19.6%, still near 10 years lows.

By that mesure, gold remains historically cheap relative to Nasdaq stocks. Do you view this ratio as a useful signal for allocation, or just misleading comparaison over time?

Source: chart by Jeff Clark / Blossom social

Source: National-Theory1218

2 Comments

You torture any data set, it will tell you what you want to hear not necessarily the truth.

Gee i wonder what made nasdaq so low in 2011